APR 29.99%

The APR of 29.99% is calculated from the cost of the product and services. The APR and payments are for a finance loan based on a 24 months term with equal bi-weekly payments. The finance loan can be repaid and closed at any time without any extra fees or penalties. Extension of credit is based on the credit guidelines of the third party program finance company. Prior to completing and signing the finance and program agreements please read the documents, terms and conditions carefully. Should you have any questions please ask your Credit Specialist or obtain legal advice prior to signing.

Canada Credit is not a lender or a loan broker, and does not offer financing of any type. All loans and financing are offered by third party lenders. Please review all documents, disclosures, terms and conditions prior to signing of the membership program agreement and the financing agreement.

Cardholder Agreement |

Website Terms of Use |

Further information can be found on CanadaCreditCard.ca

Cardholder Agreement |

Website Terms of Use |

Further information can be found on CanadaCreditCard.ca

**All Debt Settlement & Debt Management services are handled by partnered Debt Settlement & Debt Consolidation Agencies. By Submitting the Form above you are authorizing them to contact you directly.

100% Canadian Owned and Operated!

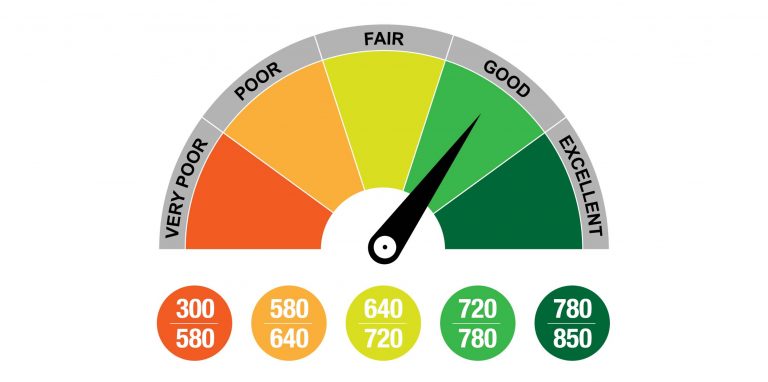

Canada Credit Improvement Systems™ provides Canada-wide credit rebuilding and credit protection services and solutions for: Alberta credit score improvement & credit report protection | British Columbia credit score improvement & credit report protection | Manitoba credit score improvement & credit report protection | New Brunswick Debt credit score improvement & credit report protection | Newfoundland credit score improvement & credit report protection | Northwest Territories credit score improvement & credit report protection | Nunavut credit score improvement & credit report protection | Ontario credit score improvement & credit report protection | Prince Edward Island credit score improvement & credit report protection | Quebec credit score improvement & credit report protection | Saskatchewan credit score improvement & credit report protection | Yukon Territories credit score improvement & credit report protection

Canada Credit Improvement Systems™ offers credit rebuilding services and credit score increase assistance and credit solutions, for TransUnion credit reports but not Equifax reports for all cities, including: Vancouver credit score improvement & credit report protection , Edmonton credit score improvement & credit report protection, Calgary credit score improvement & credit report protection, Winnipeg credit score improvement & credit report protection, Saskatoon credit score improvement & credit report protection, Regina credit score improvement & credit report protection, Ottawa credit score improvement & credit report protection, Toronto credit score improvement & credit report protection, Montreal Debt credit score improvement & credit report protection, Fredericton credit score improvement & credit report protection, Charlottetown credit score improvement & credit report protection, St. John's credit score improvement & credit report protection, Yellowknife credit score improvement & credit report protection, Whitehorse credit score improvement & credit report protection, Iqualuit credit score improvement & credit report protection and more. The Canada Credit Improvement System and CreditAdvise™ app are available in all Canadian Provinces and Territories with the exception of Nova Scotia.